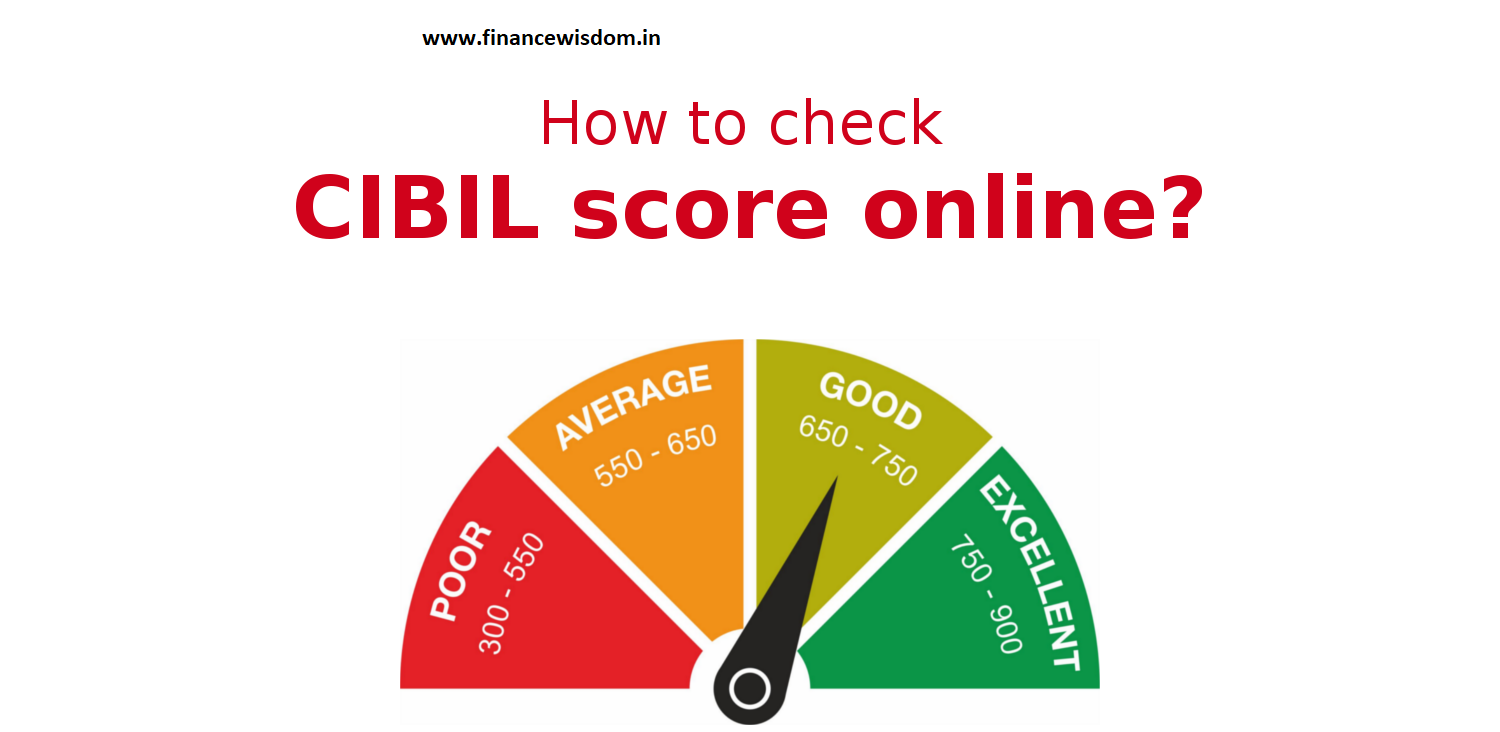

CIBIL stands for Credit Information Bureau (India) Limited. Your CIBIL score numerically represents your creditworthiness, ranging from 300 to 900. A higher CIBIL score indicates a better credit history, making you a more attractive borrower to lenders. To get a loan in SBI with the lowest interest rates a borrower should have an excellent CIBIL score which is above 750.

CIBIL Score Range

A CIBIL score ranges from 300-900. An excellent CIBIL score varies between 750-900. If a customer has a good CIBIL score then he gets a loan with ease. Here is the list of CIBIL score ranges, which is an important factor when applying for a loan.

| CIBIL Score Range | |

| NA/NH | Not applicable |

| 350 – 549 | Bad CIBIL score. |

| 550 – 649 | Average |

| 650 – 749 | Good |

| 750 – 900 | Excellent CIBIL score |

Check Your CIBIL Score Online

- Visit the official CIBIL website (https://www.cibil.com/freecibilscore) and create an account.

- Once logged in, click the “Know Your Credit Score” option.

- Enter your details, including your name, PAN number, date of birth, and contact information.

- Pay a nominal fee of ₹550 to access your CIBIL score and report.

- Your CIBIL score and report will be displayed on the screen.

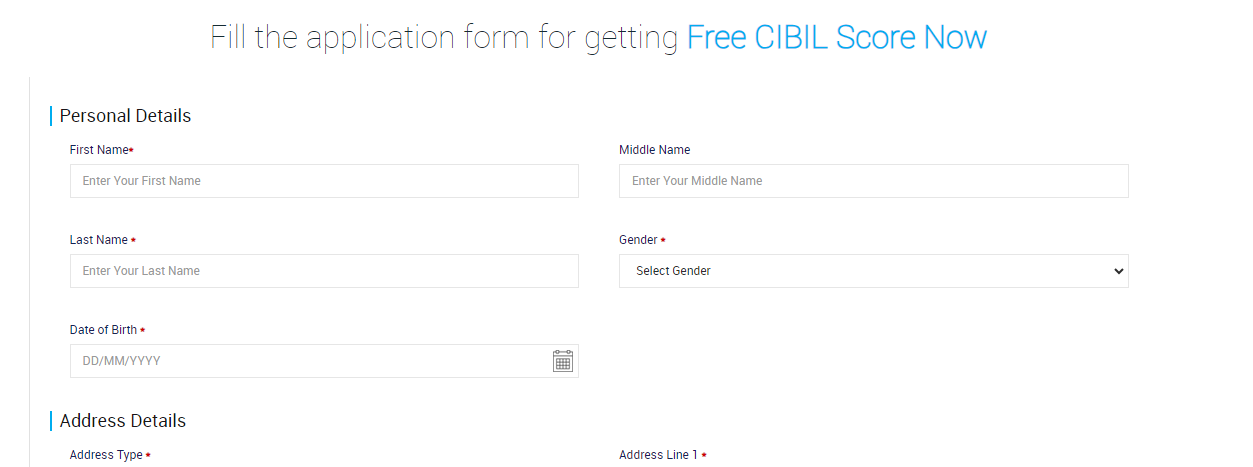

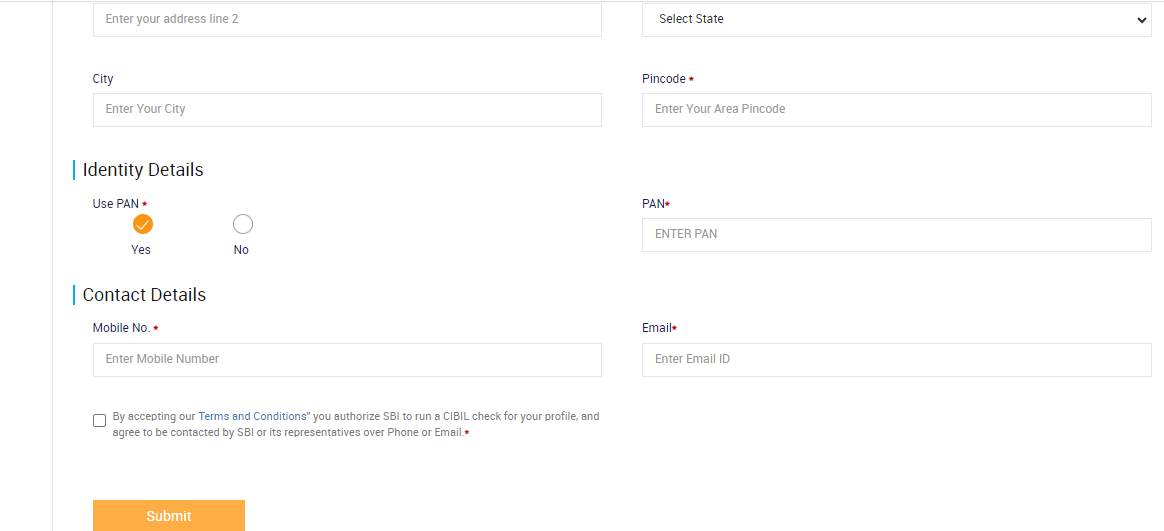

Generate SBI Free CIBIL Credit Score & Report

- To check your SBI CIBIL score click on the given link https://homeloans.sbi/getcibil.

- Firstly, you must enter all necessary details, such as your first name, last name, gender, date of birth, etc.

- After selecting all your details successfully, you must put your details such as address type- permanent, residence, office, etc.

- You will have to select your state, pin code, full address, etc.

- After selecting all these details successfully, you will have to submit your identity proof such as your passport, water ID, ration card, driving license, and PAN card no. followed by contact details (Email Address) and then further proceed by clicking on the “Submit” button.

- Afterward, an OTP will be received on your registered mobile number as well as in your mail.

- Insert the received OTP and your CIBIL Score report will be generated in PDF format.

- By Internet Banking Account: Go to My Account and Profile>>Know Your CIBIL Score.

How to Open the SBI CIBIL Score PDF Report?

A password will protect the CIBIL Score pdf report to maintain the confidentiality of the report. Here is the process to open the generated SBI CIBIL score PDF report.

The password for the SBI CIBIL score pdf report will be your full “Date Of Birth” in a prescribed format. For example, if your Date of birth is 2nd September 1995, then the password of your CIBIL pdf will be “02091995″.

Factors Affecting Your CIBIL Score

- Make timely repayments on all your loans (i.e. EMI), credit cards, and other debts.

- Keep your credit utilization ratio low (ideally below 30%).

- Avoid applying for too many loans or credit cards within a short period.

- Review your CIBIL report regularly for any errors or discrepancies.

Checking your CIBIL score regularly can help you stay on top of your credit health and make informed financial decisions. By maintaining a good CIBIL score, you can qualify for better interest rates on loans, credit cards, and other forms of credit.