Adding beneficiaries in SBI Net Banking is a crucial step for transferring funds online. Whether you’re sending money to family, and friends, or paying bills, having them added as beneficiaries simplifies the process. This article will help you to add beneficiaries in SBI Net Banking. Adding a beneficiary to your SBI Net Banking account allows you to transfer funds to them conveniently and securely. By adding a beneficiary for RTGS and NEFT you can send money above Rs. 1 lakh to the beneficiary account on a real-time basis.

How to Add Beneficiary in SBI Net Banking?

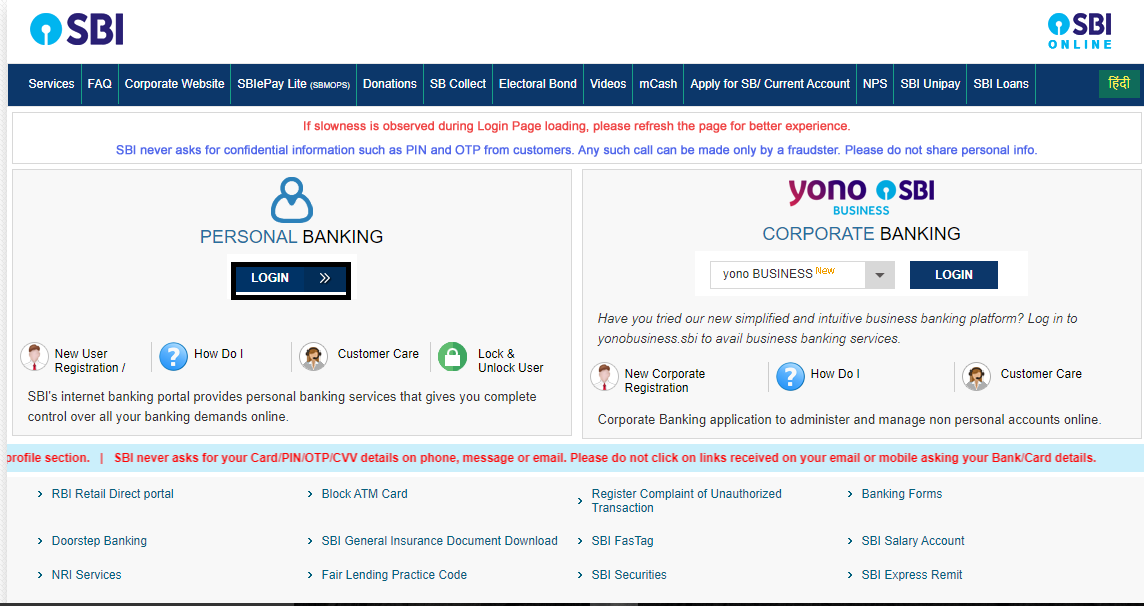

- Log in to your SBI Net Banking account: Access the SBI Net Banking portal and click on the login button as shown in the image.

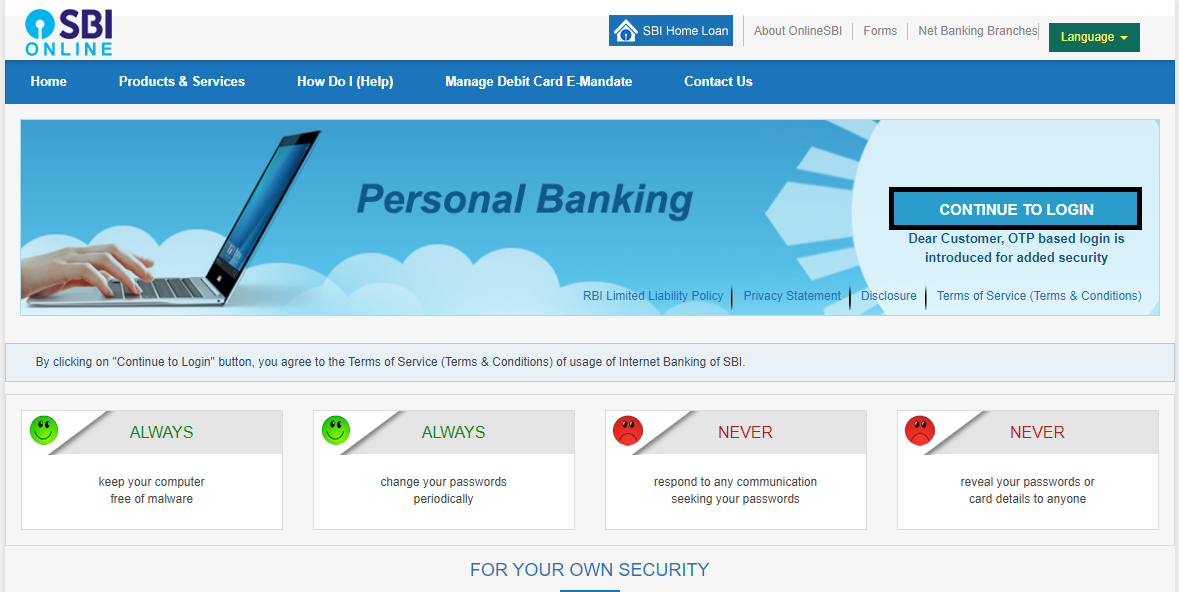

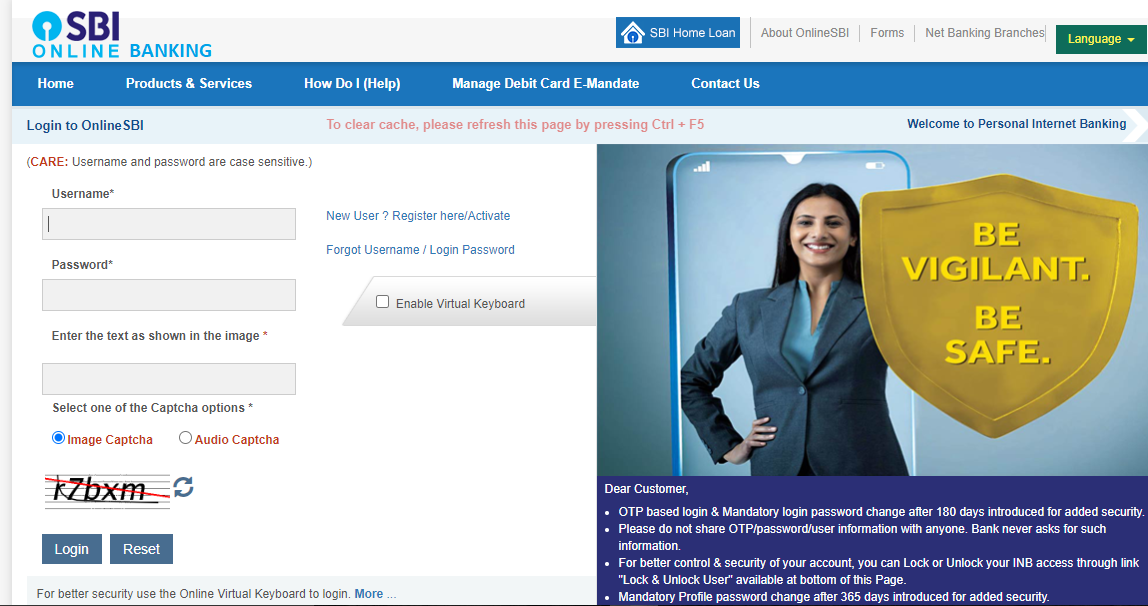

2. In the next step you can click on Continue to Login and add your user-id and password and finally click on the Login again.

3. Choose ‘Add/Manage Beneficiary’: Within the ‘Profile Management’ section, you’ll find the ‘Add/Manage Beneficiary’ option. Click on this link to proceed.

4. Enter your profile password: A pop-up window will appear requesting your profile password. Enter your profile password and click on the ‘Submit’ button.

5. Click on the ‘Add’ icon: Upon successful authentication, you’ll be directed to the ‘Add Beneficiary’ page. Click on the ‘Add’ icon located on the right-hand corner of the page.

6. Select ‘State Bank Account’: In the ‘Add Beneficiary’ window, choose ‘State Bank Account’ from the ‘Type of Beneficiary’ drop-down menu.

7. Enter beneficiary details: Provide the beneficiary’s account details, including their account number, branch name, and IFSC code (Indian Financial System Code).

8. Set transfer limit (optional): If you want to limit the maximum amount you can transfer to this beneficiary in a single transaction or a day, enter the desired limit in the ‘Transfer Limit’ field. You can skip this step if you don’t want to set a limit.

9. Click on the ‘Submit’ button: Once you’ve entered all the necessary information, review the details carefully and click on the ‘Submit’ button to add the beneficiary.

10. Approve beneficiary: A confirmation message will appear, prompting you to approve the beneficiary addition. You can approve or cancel the request.

11. Beneficiary activation: If you’ve set a transfer limit, you’ll need to activate the beneficiary through one of the following methods:

a) Internet Banking Request Approval Through ATM (IRATA): Visit an SBI ATM and insert your SBI ATM card. Select ‘Internet Banking’ and then ‘Request Approval’. Enter the beneficiary details and approve the request.

b) Branch Activation: Visit your SBI branch and submit a beneficiary activation request form along with a copy of your identity proof. The bank will process your request and activate the beneficiary within a few working days.

Once the beneficiary is activated, you can start transferring funds to their account using SBI Net Banking. Remember to set a transfer limit if you haven’t already done so.

Benefits of Adding Beneficiaries in SBI Net Banking

- Save time and effort: No need to manually enter account details repeatedly. Once a beneficiary is added, transferring funds becomes a breeze.

- Faster transactions: With pre-registered information, fund transfers are processed quicker, saving you valuable time.

- Simplified bill payments: Pay your recurring bills like utilities, rent, or insurance premiums with a few clicks without remembering account numbers and IFSC codes.

- Reduced risk of errors: Eliminate the risk of typos or incorrect information while entering account details manually.

- Double-check mechanism: SBI Net Banking prompts you to confirm the beneficiary details before transferring, minimizing the chances of mistakes.

- Fraud protection: Adding beneficiaries helps prevent unauthorized transactions by ensuring your funds reach the intended recipient.

- Schedule transfers: Schedule recurring payments for bills or investments in advance, ensuring timely payments without any hassle.

- Transfer limits: Set transfer limits for each beneficiary, ensuring safe and controlled online transactions.

- Track your transactions: View a detailed history of your fund transfers for better financial management.

-

Easy Activation Process: Adding beneficiaries in SBI Net Banking is a straightforward process. You can easily do it through the online portal or mobile app. The system also offers various activation options like online verification, ATM validation, or branch verification, ensuring added security.

Additional tips

- You can add multiple beneficiaries for different purposes.

- You can edit or delete existing beneficiaries anytime.

- For higher transaction limits, you may need to visit your SBI branch.

- Always ensure your internet connection is secure while adding or managing beneficiaries.

Conclusion

Adding beneficiaries in SBI Net Banking is a straightforward process. By following these steps, you can easily add and manage beneficiaries for convenient online fund transfers. Remember to follow safe practices and secure your account information for a smooth banking experience.