Bank of Baroda provides Net Banking 24/7 from everywhere and all the time. With the help of BOB Net banking, you can check your account details and FD status, and you can also transfer money from your home, offices, etc. So, in today’s world, Net Banking is an essential thing for everyone. The post will guide you step to step process of how to activate Bank of Baroda net banking.

Steps on How to Activate Bank Of Baroda Net Banking?

By Online Registration

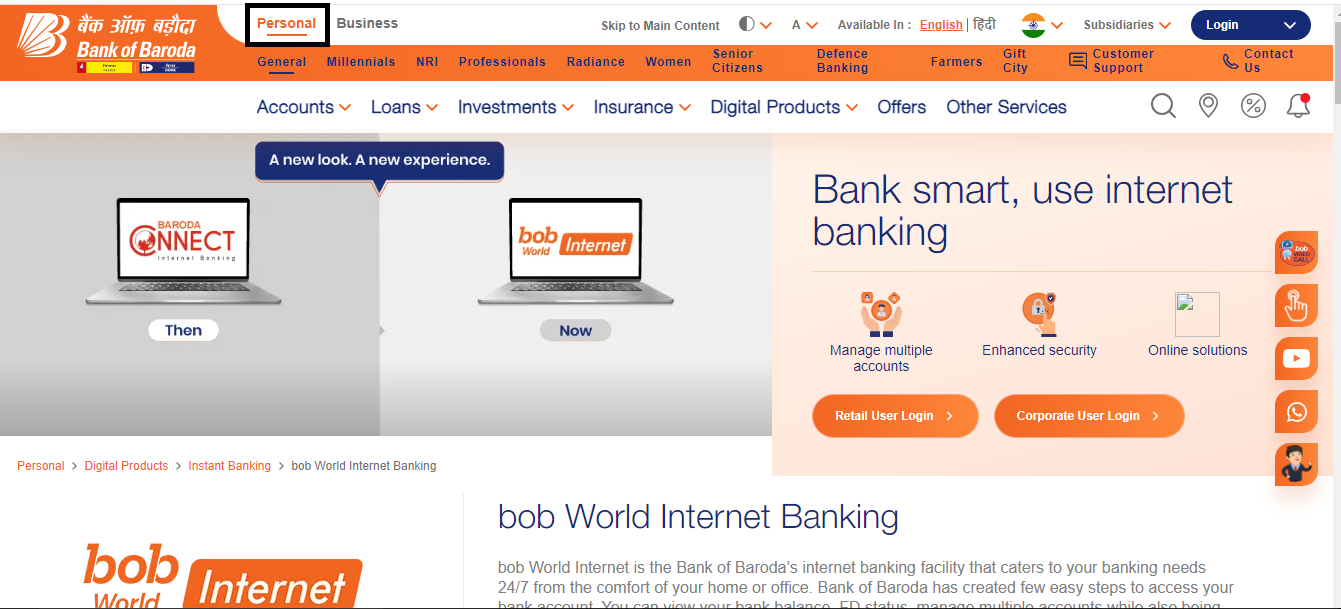

- Firstly, go to the official site of the Bank of Baroda and navigate to the “Personal Banking” section.

- Under “Digital Products,” click “Instant Banking” and then “Bob World Internet Banking.” Now, You’ll find the “Download Application Form” link for both Retail and Corporate users. Download the appropriate form based on your account type.

- Print and carefully fill out the downloaded form with your accurate personal information, account details, and desired login details. Remember that, all joint account holders or partners in a firm need to sign the form.

- Submit the form: There are three ways to submit the completed form:

- Offline: Visit your nearest BOB branch and submit the form along with a photocopy of a canceled cheque from your BOB account.

- Postal mail: Send the form and cheque photocopy to the address specified on the form.

- Online: Use the “Bob Billpay” website (https://www.Bob Billpay.com) for online registration. Upload the scanned copies of the form and cheque photocopy.

- Confirm and activate: Once BOB verifies your details, you’ll receive a confirmation email containing your User ID and temporary password. Follow the instructions in the email to activate your account and set your permanent login credentials.

Through Offline Registration

- Visit your BOB branch: Visit any Bank of Baroda branch that is near to you with a valid photo ID and a copy of your passbook or account statement.

- Request the form: Inform the bank representative about your need to register for BOB Net Banking. They will provide you with the appropriate application form.

- Fill and submit: Fill out the form carefully with all your details and submit it along with the required documents, usually a photocopy of your PAN card and address proof.

- Verification and activation: The branch will verify your information and process your application. Upon approval, you’ll receive similar instructions as in online registration to activate your account and set your login details.

Eligibility for Bank of Baroda Net Banking

- Ensure you have a valid mobile number linked to your BOB account, as it’s crucial for receiving OTPs and security alerts.

- You must be of legal age to enter into a contract, which in India is 18 years old.

- You must be an existing BOB customer with an active savings, current, or time deposit account.

- A valid email address is necessary for registration and receiving important notifications.

- An active mobile number linked to your account is required for receiving one-time passwords (OTPs) for secure transactions.

- If you don’t have a debit card, you can still register for BOB Net Banking by visiting your nearest branch. However, having a debit card allows for convenient online registration through the BOB website.

Benefits of Bank of Baroda Net Banking

- Fund Transfer through IMPS/ NEFT or RTGS.

- With the help of BOB Net Banking customers can pay Tax easily.

- Pay utility bills, mobile recharges, credit card dues, and even insurance premiums effortlessly through BOB World. No more juggling paper bills or standing in lengthy queues.

- Pay tuition fees.

- You can also Book rail & air tickets online.

- Open online fixed deposit or recurring deposit.

- Debit Card Management- for Card insurance, set limit, PIN, and Block for debit cards.

- BOB Net Banking is the best way to quick way to Fund Transfer.

- BOB Net Banking is a cost and time-saving process because of No more branch visits, long queues, or travel expenses.

Features of BOB Net Banking

- Quick Fund Transfer:- With the help of BOB net banking you can transfer your money very quickly. This is the process without adding and waiting for the beneficiary to be listed.

- Limits:– Transaction limit for Retail customers: Rs. 25,000/- per day.

- Maximum number of transactions per: 2

- Transaction limit for Corporate Customers: Rs. 50,000/- per day.

- Maximum number of transactions per: 2

- Bulk NEFT / RTGS:- Corporate customers can perform interbank transfers for multiple beneficiaries with one attempt. Transaction Limit: Rs. 30 Lakhs per transaction and Rs. 75 lakhs per day.

- Debit Card:– Customer can apply for a debit card and manage other activities like Block Debit Card, Set/Reset Debit Card PIN, Set daily debit card limit for ATM transactions, etc.

- With the help of BOB Net Banking, you can also Manage your multiple accounts with Bank of Baroda.

- Form 26AS:- Free online viewing of Tax Credit Statement (Form 26 AS).

How to Transfer Money Through BOB Net Banking?

Bank of Baroda’s net banking offers convenient ways to transfer funds. Here’s a straightforward guide:

1. Login

Visit the Bank of Baroda website and access “Bob World Internet Banking.” Enter your login credentials and authenticate using the OTP received on your registered mobile number.

2. Choose Transfer Option

Navigate to the “Transfers” section on the homepage. Here, you’ll see various options based on your recipient’s bank:

- Within Bank Transfer: For transfers within your Bank of Baroda accounts, select “Transfer to own account.” Choose the source and destination accounts, enter the amount, and confirm the transaction.

- Other Bank Transfer: To transfer to accounts in other banks, choose “Transfer to another bank account.” Here, you have two options:

- NEFT/RTGS: For large amounts or urgent transfers (with fees), select “NEFT” or “RTGS.” Add the beneficiary details (name, account number, IFSC code) and proceed.

- IMPS: For instant transfers (up to a certain limit, with fees), choose “IMPS.” Enter the beneficiary’s mobile number linked to their bank account and complete the transfer.

3. Verify and Confirm

Review the transfer details on the screen. Ensure all information, including amount and beneficiary details, is accurate. Finally, confirm the transaction using the OTP received on your phone.

4. Track your Transfer

You can track the status of your transfer within the “Transactions” section of your net banking account.

Remember:

- Keep your login credentials confidential and avoid accessing net banking on public Wi-Fi.

- Double-check beneficiary details before confirming the transfer.

- Be aware of transaction limits and fees for different transfer methods.